Introduction

Financing business or the world of finance and accounts are focused on precision and accuracy. For any kind of business maintaining financial transactions is a crucial aspect. However, managing financial transactions is important for individuals also.

Moreover, one essential tool that plays a vital role in the process of accounting is generating ledger reports. In this blog, we will explore what a ledger report is. Also, explore its importance and how it helps in accounting.

What is a ledger report?

A ledger report is a comprehensive document that provides detailed information on a company’s financial transactions. In addition, It serves as a critical component of the general ledger, which is the core accounting record that houses all financial data.

Also, you can say that the ledger report offers a snapshot of the financial health of an organization. Ledger reports are divided into different categories of various accounts. Such as assets, liabilities, equity, revenues, and expenses.

The process of creating a ledger report is not a difficult task. However, To create a ledger report, accountants and financial professionals record each transaction in the general ledger using double-entry bookkeeping principles.

Each entry is made in two accounts. With one entry representing a debit and the other representing a credit. However, the ledger reports help to compile these individual entries into a coherent, organized, and easy-to-understand format.

Importance of ledger reports

Ledger reports serve as a central repository for all financial transactions. The main aim or importance of the ledger reports is organized record-keeping. It makes it easy for businesses to track and verify their financial activities over time.

However, This organized record-keeping is essential for compliance, auditing, and decision-making processes.

Accuracy and Transparency

Ledger reports help ensure the accuracy and transparency of financial data. With ledger reports, errors and discrepancies can be quickly identified and corrected, promoting trust and confidence among stakeholders.

Financial Analysis

Ledger reports are a valuable tool for financial analysis. As a result, stakeholders can make informed decisions about investments, budgeting, and strategic planning based on a clear picture of an organization’s financial performance.

Auditing

Ledger reports are essential for businesses to comply with legal and regulatory requirements. The auditable records provide a comprehensive record of financial transactions that can be used to confirm compliance with tax laws and industry regulations.

Decision-Making

Businesses often rely on ledger reports to make critical decisions, such as whether to expand, cut costs, or invest in new projects. These reports offer insights into the financial consequences of various choices.

How Does it Help in Accounting?

- Ledger reports allow accountants to keep a detailed record of every financial transaction, ensuring that nothing is overlooked.

- By recording transactions as debits and credits, ledger reports help maintain the fundamental accounting equation (Assets = Liabilities + Equity) and ensure that all accounts are properly balanced.

- Ledger reports serve as the foundation for creating financial statements such as the balance sheet, income statement, and cash flow statement. These statements offer a comprehensive view of an organization’s financial health.

- Ledger reports provide a clear audit trail for financial transactions, making it easier for auditors to review and verify financial data for accuracy and compliance.

- Accountants and financial professionals use ledger reports to provide essential information to management, enabling them to make data-driven decisions to achieve organizational goals.

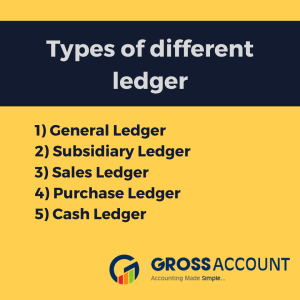

Types of Ledgers

Ledgers are categorized into several types based on their functions and purposes in accounting. Here are some types written for the ledger.

1) General Ledger

The general ledger is also known as the nominal ledger. However, It is the central accounting ledger that contains all financial transactions of a business. It consists of various accounts, including assets, liabilities, equity, revenues, and expenses. Entries from subsidiary ledgers are summarized and posted to the general ledger.

2) Subsidiary Ledger

Subsidiary ledgers are used to provide more detailed information on specific types of transactions or accounts. They are linked to the general ledger and help in maintaining detailed records. Moreover, it is divided into different categories like accounts receivable, accounts payable, inventory, and fixed assets.

3) Sales Ledger

Also known as the accounts receivable ledger, this ledger records all credit sales made by a business. It keeps track of individual customer accounts, including amounts owed and payment histories.

4) Purchase Ledger

The purchase ledger, or accounts payable ledger, records all credit purchases made by a business. It maintains records of suppliers, amounts owed, and payment terms.

5) Cash Ledger

This ledger is dedicated to tracking cash transactions, including cash receipts and cash disbursements. It helps in monitoring the flow of cash within a company.

How to read a ledger report

Reading a ledger report involves understanding the format.

First, you need to identify the date range. Look for the date range that is covered by the ledger report. This indicates the period for which the financial transactions are summarized.

Second, you need to see account titles. The ledger report will list various account titles or account numbers. These titles correspond to the different categories of financial transactions, such as assets, liabilities, equity, revenues, and expenses.

After that show the data of the debits and credits. For each account, there will be two columns, one for debits and one for credits. Debits are typically listed on the left, and credits are on the right.

The report will also include descriptions of each transaction, providing details about what the transaction represents. This information helps you understand the nature of the entries.

Many ledger reports include running balances for each account. These balances show the cumulative effect of all transactions up to a given point in time.

Reading a ledger report requires a good understanding of accounting principles and the specific accounts being analyzed. It serves as a foundational tool for financial analysis, reporting, and decision-making within an organization.

Summary

Ledger reports are important and the first part of the accounting. Their importance can not be overstated. Moreover, it not only ensures the accuracy and transparency of financial data but is also important for decision-making.

However, GrossAccount helps you to do accounting with automation. Our GST accounting software offers a comprehensive solution for every organization. Ledger reports are an important feature of the grossaccount. Book your FREE DEMO now and get more information.