Introduction

People often confuse the term bookkeeping and accounting. However, some people think it is the same as accounting. Bookkeeping serves as the backbone of any successful business. It also provides detail about the company’s financial health. But later, in this blog, we will cover what is the main difference between them. First, we need to understand what is financial bookkeeping.

What is Financial Bookkeeping?

Bookkeeping is part of accounting. Bookkeeping starts with identifying the financial transaction of one company. Financial transaction means every debit and credit money of one organization.

Whereas, Financial bookkeeping is the process of keeping records. Same concept – financial bookkeeping is records of daily transactions. With summarizing of each business transaction every individual entry is entered into the ledger accounts. From these ledger accounts, accountants prepare their financial statements. This statement’s period could be weeks, months or years.

Definition of Bookkeeping

“Bookkeeping is an art of recording business dealings in a set of books” – J.R.Batliboi

Bookkeeping is the systematic process of recording, classifying, and summarizing the financial transactions of a business. It involves maintaining accurate and up-to-date records of all monetary inflows and outflows.

It also provides the foundation for financial accounting. However, It forms the basis for preparing financial statements such as income statements, balance sheets, and cash flow statements.

However, the Bookkeeping process is done by any beginner accountant. For this process person does not need a detailed knowledge of accounting.

Objectives of Bookkeeping

To Record the Transactions

Bookkeeping’s first objective is (as we see earlier) to maintain records of all financial transactions.

These transactions can be useful for future uses.

To show the situation of the organization

It helps financial investors to know about the company’s financial situation. In addition, it can encourage the investor to implement some money in any organization. It also helps the company to formulate future policies and plans.

To detect errors and fraud

As we show bookkeeping is the basic function of the balance sheet and different statements. Moreover, bookkeeping help to find any errors that occur in these types of different statements.

Types of Bookkeeping

1) Single-Entry Bookkeeping

Single-entry bookkeeping is the simplest form, commonly used by small businesses or individuals. It is a basic system to record daily transactions. Also represents the weekly or daily report of the company’s cash flow. It involves recording transactions in a single column, typically in a cash book or spreadsheet. It involves the recording of only one side of the money activity. This method primarily focuses on tracking cash flows, including income and expenses, and may not provide a comprehensive financial picture.

2) Double-Entry Bookkeeping

Double-entry bookkeeping is the most widely used method by businesses. It follows the fundamental accounting principle that every transaction has two sides—an equal debit and credit. This system provides a more accurate and complete financial record as it captures both the source and destination of funds. It ensures the maintenance of the accounting equation (Assets = Liabilities + Equity) and allows for the identification of errors through trial balances. However, this system is globally the most accepted financial transaction.

Importance of Bookkeeping

Businesses of all sizes, types, and industries need bookkeeping regardless of their size, nature, or business transactions. Keeping proper records is crucial when starting a business.

1) It helps in Financial Decision Making

Financial bookkeeping with its accuracy provides small businesses or even big organizations with a clear understanding of the company’s financial position. It helps business owners to understand where to invest, and when to invest. In addition, it can help in business growth. It helps to determine pricing strategies, what is the right value for any product.

Bookkeeping also helps to identify cost-saving opportunities and evaluate profitability. Timely financial insights gained through bookkeeping help drive strategic planning and ensure the long-term success of the business.

2) It helps to incorporate Legal Compliance and Tax Obligations

With the maintenance of the records of the company’s daily statements, businesses can have an overall idea if they can meet their tax obligations or not. Bookkeeping helps to prepare financial reports for government agencies and demonstrate compliance with accounting standards. So, It plays a crucial role in fulfilling legal and regulatory requirements.

Moreover, accurate records of the bookkeeping help to prevent the risk of penalties, audits, and legal issues. It ensures that businesses operate within the boundaries of the law.

3) Financial Analysis with Bookkeeping

Bookkeeping enables businesses to analyze their financial performance. It is also important for businesses to identify the trends of the market and bookkeeping is help to do so. It is an important part of financial statements like Creating balance sheets and cash flow statements. However, It helps to provide valuable insights into revenue, expenses, assets, liabilities, and cash management.

Regular financial analysis helps identify strengths, weaknesses, and areas for improvement, aiding in effective financial planning and goal setting.

4) It Becomes Easy to Find Business Growth

Accurate bookkeeping is essential for securing funding and attracting potential investors. Whenever an investor invests in the money of one business then it must look into the financial situation of the business and it finds easily with bookkeeping. They require historical data to evaluate businesses’ stability and potential to grow. A well-maintained bookkeeping system demonstrates professionalism, transparency, and financial reliability, increasing the chances of obtaining financing and expanding the business.

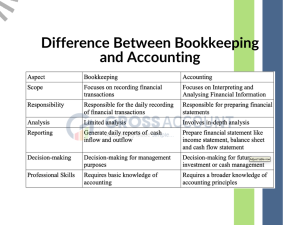

Difference between Bookkeeping and Accounting

Conclusion

In conclusion, Bookkeeping is might a time-consuming and error-prone task. So, Automation is the key to keeping financial records properly. And with accounting software businesses can achieve that. There are several accounting software in the market. But GrossAccount offers one of the best solutions of Accounting Software with the automation feature of Bookkeeping. Gross Account’s Software has several features that might suitable for you. Also, We provides the customization feature according to your business requirement.