Introduction

The Union Budget of 2023 was released just as the Indian economy was preparing for a period of rapid growth. Generally, the budget before the election year is always crucial and everyone hoping for big news. This year’s budget was no exception as it was mostly just a reallocation of funds to old schemes.

The Budget mentioned its 7 priorities for the upcoming year.

- Inclusive development

- Reaching the last mile

- Infrastructure and Investment

- Unleashing the Potential

- Green Growth

- Youth Power

- Financial sector

But the major change in the tax regime. Various tax relief measures were introduced under these. The government wants that taxpayers switch to the new tax regime and phase out the old tax regime. The increase in duty on cigarettes, which was missing for three years.we How the new tax regime will affect the businesses

Contents:

What are the key Takeaways from Tax

Changes in GST as per Union Budget.

New Tax Regime V/S Old Tax Regime

What is Union Budget?

The Union Budget, also called as Annual Financial Statement(AFS) under Article 112 in the Constitution of India. It is a document of the Indian central government that provides information on how much spending will occur in the upcoming year.

The finance minister Nirmala Sitaraman presented the Union Budget 2023. each year on 1st February the budget will be presented in the parliament assembly call as Sanshad Bhavan. The finance minister gives a speech about the budget and the ruling government passes the budget with the voting power of members.

What are the key Takeaways from Tax?

No Changes in Personal Income Tax Rates – The budget did not announce any changes in the personal income tax rates. The current tax slabs and rates remain unchanged.

Tax on High Net Worth Individuals – A new tax has been introduced for high net worth individuals (HNIs) earning more than Rs. 5 crores per annum. These individuals will have to pay a surcharge of 10% of their income.

In the Union Budget 2023, the Input Tax Credit(ITC) for CSR expenses has been proposed as one of several changes to the taxation of CSR activities.

Inclusion of Transactions from Schedule III in the exempt supply The Union Budget 2023 proposes to include transactions from Schedule III in the exempt supply.

An amendment to Section 2(16) of the IGST Act makes taxable OIDAR services provided by anyone in non-taxable territory to an unregistered person in taxable territory.

What is GST?

GST stands for Goods and Services Tax, which is a unified indirect tax system implemented in India on July 1, 2017. It replaced multiple taxes like excise duty, service tax, VAT, and others that were levied by the central and state governments on goods and services.

Under the GST system, a single tax is levied on the supply of goods and services from the manufacturer to the consumer, with credit for the taxes paid at each stage of the supply chain. The tax rate varies based on the nature of the product or service, with four main tax slabs 5%, 12%, 18%, and 28%.

GST is administered by the Goods and Services Tax Council, which is chaired by the Union Finance Minister and includes the finance ministers of all the states and union territories. The implementation of GST has simplified the tax system in India and has led to greater compliance and transparency in tax collection.

Changes in GST as per Union Budget

GST Rate Reduction for Electric Vehicles:

The GST rate for electric vehicles has been reduced from 5% to 3%. This is aimed at promoting the use of electric vehicles and reducing pollution levels in the country.

GST Rate Hike for Luxury Goods:

The GST rate for luxury goods has been increased from 20% to 28%. This includes items like high-end cars, private jets, and yachts.

Increase in GST Registration Threshold:

The threshold for GST registration has been increased from Rs. 20 lakhs to Rs. 40 lakhs for businesses. This will provide relief to small businesses and reduce their compliance burden.

Simplification of GST Filing:

The government has introduced a new simplified GST filing system. The new system will reduce the number of returns to be filed from 3 to 2, and the due dates for filing returns will be staggered to ease the compliance burden on taxpayers.

GST Refunds for Exports:

The government has announced a new scheme for providing quick refunds of GST to exporters. Under this scheme, refunds will be processed within 72 hours of applying.

Introduction of GST Audit

In the Union Budget 2023, a GST audit will be implemented for taxpayers with a turnover of more than Rs 10 crore. An independent auditor will carry out the audit, which will examine all aspects of GST compliance, including returns, invoices, and input tax credits. The audit will assist in reducing the potential for GST evasion and enhancing taxpayer compliance.

ITC on CSR / Corporate Social Responsibility

Corporate social responsibility (CSR) aims to ensure that businesses take responsibility for the effects they have on society, the economy, and the environment. CSR is an essential component of the business ecosystem. The eligibility of the ITC – Input Tax Credit on CSR expenses is one of several changes to the taxation of CSR activities that have been proposed in the Union Budget 2023

New Tax Regime V/S Old Tax Regime

The Union Budget 2023 has left the personal income tax rates unchanged, which means that the tax slabs and rates under the old tax regime continue to apply. However, taxpayers have the option to choose between the old and new tax regimes, depending on which is more beneficial to them. Let’s take a look at the differences between the new and old tax regimes in the 2023 Union Budget:

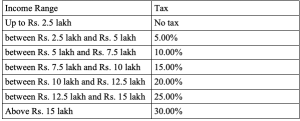

Old Tax Regime:

Under the old tax regime, taxpayers can claim various deductions and exemptions, such as HRA, LTA, standard deduction, and Section 80C deductions, among others. The tax rates under the old tax regime are as follows:

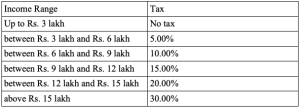

New Tax Regime:

The new tax regime offers lower tax rates as compared to the old tax regime. However, taxpayers cannot claim any deductions or exemptions under this regime. The tax rates under the new tax regime are as follows:

Which Regime to Choose?

Taxpayers can choose between the old and new tax regimes, depending on which is more beneficial to them. If a taxpayer claims a lot of deductions and exemptions, then the old tax regime may be more beneficial. On the other hand, if a taxpayer does not have many deductions and exemptions, then the new tax regime may result in lower taxes. It is important to calculate the tax liability under both regimes and choose the more beneficial one.

Conclusion

The Union Budget 2023 has brought some relief to the common man by not increasing the personal income tax rates and increasing the standard deduction for salaried employees. At the same time, it has introduced a new tax for high-net-worth individuals and increased the GST rates for luxury goods.

The reduction in GST rates for electric vehicles and the increase in the GST registration threshold for businesses will provide some relief to small businesses. The new simplified GST filing system and the quick refund scheme for exporters will also ease the compliance burden on taxpayers.

GST Accounting Software helps you to get along with the tax regime. It can lower your burden with features like GST/non GST invoices, Generating accurate reports, Financial transaction bookkeeping, and GSTR-9. GST accounting software is customizable so it can customize according to your business and handle all the company’s needs.