Introduction

The Goods and Services Tax (GST) has revolutionized the tax structure in India and changed the GST Return Filing to simplify the taxation process and promote ease of doing business. Under the GST regime, businesses are required to file regular GST returns to comply with tax regulations. In 2023, Union implemented the new tax regime and do some cfi

Also Read: Union Budget 2023: Key Takeaways on Tax and GST Proposals

However, sometimes businesses might miss the due dates for filing their GST returns, leading to the imposition of late fees and interest. In this blog post, we will see the details of GST return filing, the implications of late fees and interest, and provide insights into checking GST penalties.

Before diving into the late fees and interest, let’s understand the basics of GST return filing. GST return filing refers to the process through which registered taxpayers report their business’s income, sales, purchases, and tax liabilities to the government. It ensures that the government can effectively monitor and collect taxes from businesses.

There are various types of GST returns, including GSTR-1, GSTR-3B, GSTR-4, GSTR-9, and more, each serving a specific purpose. The frequency of return filing depends on the type of taxpayer and their turnover.

Late Fees of GST Return Filing

Late Fees and Due Date for GSTR-3B

Every month (quarterly for the QRMP scheme), taxpayers must file GSTR-3B, a self-declared GST summary return. Taxpayers must report sales, input tax credits(ITCs), and net tax payable on this return.

GSTR-3B: What are the late fees per day?

It depends on whether you file regular GSTR3B returns or nil GSTR3B returns or whether you pay late fees.

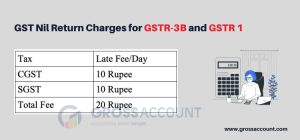

Late fees on nil return – 20 rupees per day

Late fees on normal returns – 50 rupees per day

As an example, if a business files its GST return under GSTR-3B on 25th January, then the late fee to be paid by the business will be for 5 days.

In case of a normal return, the amount payable would be 5*50 = 250 rupee

In case of a Nil Return, the amount payable would be

When a taxpayer who has registered under the Goods and Service Tax(GST) regime has not made any outward supplies (sales) or has not made any purchases or expenses that are eligible for input tax credits(ITCs), he or she must file a Nil return on GSTR-3B. As a result, the taxpayers are not liable for any tax or ITC. Despite this, the taxpayer must still file a GSTR-3B return by declaring ‘nil’ sales, ITC, and tax liability.

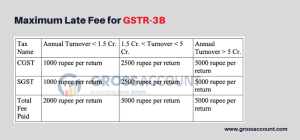

Maximum Late Fee for GSTR-3B

GSTR-3B filing late fees are determined according to the annual turnover slab, except for nil filings. Here is the summary of the data:

-

In the case of two pending returns, for instance, January and February, you must pay a late fee for each one.

-

In GSTR 3B, the maximum late fee for filing a nil return is Rs 500 (CGST + 250) per return.

GSTR-3B Due Dates

GSTR 3B filing due dates are based on your company’s previous year’s turnover.

-

The deadline for filing GSTR-3B if your company’s turnover in the previous year was less than 5 crores is the 20th of the following month. Example: April 2023 return is due on 20th May 2023.

-

A company with a turnover of more than 5 crores must file GSTR-3B on or before the 22nd of the succeeding month if its previous year’s turnover was equal to more than 5 crores. Example: April 2023 return is due on 20th May 2023.

You can avoid late fee penalties by using GrossAccount’s Software to file your returns on time.

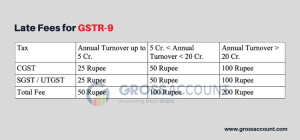

Late Fees for GSTR-9

GST Nil Return Charges for GSTR-3B and GSTR 1

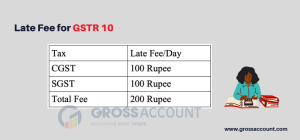

Late Fee for GSTR 10

Penalty for Late Filing of GSTR 3B

There is interest charged for late deposits of taxes besides the late fees for GSTR-3B, GSTR 10 and GSTR 9. This interest is calculated based on the late payment of GST liabilities and applied to the net tax liability after reducing input tax credit claims. The interest is paid by every taxpayer:

-

Who pays the GST late after the due date

-

Who makes input credit claims

-

Taxpayers who decreases the extra output tax liability.

When GST is made after due dates the interest is imposed:

-

Taxpayers who pay late interest late have to pay 18% per annum interest from the next day is imposed.

-

The taxpayers are required to pay interest of 24 % per annum if he/she avails of excess input tax credit or reduces excess output tax liability.

Conclusion

Understanding the implications of late fees and interest in GST return filing is crucial for businesses to maintain tax compliance and avoid financial penalties. The late fee provisions act as a deterrent to encourage the timely filing of GST returns, while interest charges ensure the prompt payment of outstanding tax liabilities.

Late fees are imposed when businesses fail to file their GST returns within the prescribed due dates. Interest charges are levied on the outstanding tax amount that remains unpaid after the due date. The interest rate is set at 18% per annum for both regular taxpayers and composition scheme taxpayers. To check GST penalties, taxpayers can easily access the official GST portal and log in to their accounts.

Utilizing platforms like GrossAccount can simplify this process, providing accurate calculations and reminders to ensure compliance and avoid penalties. By leveraging technology and staying informed, businesses can contribute to a seamless and efficient GST ecosystem.

FAQs

Can we file GSTR9 without paying the late fee?

No, a late fee is applicable for delayed filing of GSTR9. Timely payment of fees is required for compliance.

What is the interest rate notification for GST?

The interest rate for delayed GST payments is 18% per annum. It is essential to pay taxes on time to avoid interest charges.

Is GSTR1 required for nil return?

Yes, GSTR1 must be filed even for nil returns. Non-filing may attract penalties and impact compliance.

What if I don’t pay a late fee of GST?

Non-payment of GST late fees can lead to penalties, interest charges, and legal consequences. It is critical to comply with payment obligations.