Introduction

In the world of accounting, Traditional accounting & cloud-based accounting, Everybody knows some basic knowledge about these two primary methods of managing financial records. Accounting is an essential part of any business, and how you manage your financial records can have a significant impact on your success. In this blog post, we’ll take a closer look at cloud-based accounting vs. traditional accounting and help you decide which option is right for your business.

For basic knowledge, traditional accounting involves using manual methods or desktop software to manage financial records, while cloud-based accounting is an online system that stores financial data in the cloud. Both methods have their uses and some flows, but in recent years, cloud-based accounting has become increasingly popular due to its convenience and accessibility.

GrossAccount is a company that offers cloud-based accounting software solutions for businesses of all sizes. Their software is designed to be easy to use, with features that allow users to manage their financial records, track expenses, create invoices, and more. With GST accounting software, businesses can streamline their financial operations and save time and money in the process.

As we look ahead to 2023, it’s clear that cloud-based accounting software will continue to be a dominant trend in the accounting industry. Businesses are increasingly turning to cloud-based solutions to manage their financial records, and software developers are responding by creating more advanced and user-friendly software.

In addition, artificial intelligence and machine learning will play a more significant role in accounting software, helping businesses to automate repetitive tasks and make better financial decisions.

Check Out: Accounting software trends 2023

Traditional accounting

Traditional accounting involves using manual methods or desktop software to manage financial records. This method requires businesses to have an in-house accounting team or to outsource their accounting needs to a professional accountant.

With traditional accounting, businesses must ensure that all financial records are kept up-to-date and accurate, which can be a time-consuming and labor-intensive process.

Advantages of Traditional accounting

Complete Control over Financial Records

One of the main advantages of traditional accounting is that it gives businesses complete control over their financial records. Traditional accounting can be particularly important for businesses that have complex financial needs or that handle sensitive financial information.

No Need for Internet Access

Another advantage of traditional accounting is that it doesn’t require Internet access. With cloud-based accounting software, businesses must have an internet connection to access their financial records. This can be a problem for businesses that operate in remote areas or that have unreliable internet connections.

More Personalized Service

With traditional accounting, businesses can work with a professional accountant who can provide personalized advice and support. This can be particularly valuable for small businesses that may not have an in-house accounting team.

Disadvantages of Traditional accounting

However traditional accounting has more flows than its uses. Some of them are mention here:

Time-consuming

Traditional accounting can be very time-consuming as it involves manual data entry and calculations. This can result in delays and errors.

Limited access to data

With traditional accounting, financial data is stored in physical ledgers or desktop software, making it difficult to access from anywhere other than the business premises.

Prone to errors

Traditional accounting methods are more prone to human error as it involves manual data entry and calculations.

Difficult to scale

Traditional accounting methods can be difficult to scale as the workload increases, leading to more resources and time needed.

Higher costs in the long run

While traditional accounting may be cheaper in the short term, it can become more expensive in the long run due to the need for maintenance, upgrades, and replacement of outdated software.

Cloud-based accounting

Cloud-based accounting is an online system that stores financial data in the cloud. With cloud-based accounting, businesses can access their financial records from any device with an internet connection. This type of accounting software is designed to be user-friendly and easy to use, making it an ideal choice for small businesses and startups that do not have an in-house accounting team.

Advantages of Cloud-based accounting

Real-Time Data Access

One of the biggest advantages of cloud-based accounting is that it provides real-time access to financial data. With cloud-based accounting, businesses can access their financial data from anywhere, at any time. This means that businesses can stay up-to-date with their financial information and make informed decisions based on real-time data.

Collaboration and Sharing

With cloud-based accounting, multiple users can access the same data simultaneously, and changes made by one user are immediately reflected for all users. This makes it easier for teams to work together and ensures that everyone has access to the most up-to-date financial information.

Automatic Backups and Updates

With cloud-based accounting, backups and updates are automatic, which reduces the risk of data loss and ensures that businesses are always using the latest software.

Lower Upfront Costs

In this type of software, businesses typically pay a monthly or yearly subscription fee, which is often more affordable than the upfront costs of traditional accounting.

Scalability

Cloud-based accounting is also more scalable than traditional accounting. With cloud-based accounting, businesses can easily scale their accounting software and services as their needs change. For example, businesses can add or remove users or services as needed, which makes it easier to manage costs and resources.

Dis-Advantages of Cloud-based accounting

However, cloud-based accounting has fewer flows than traditional accounting. But here are a list:

Internet Dependency

Cloud-based accounting is reliant on a stable and secure Internet connection. If the internet connection is disrupted, the user may not be able to access the accounting software or data.

Security Concerns

While cloud-based accounting has improved security features, there is still a risk of data breaches and cyberattacks. As financial data is stored online, there is always a risk of unauthorized access to the data.

Limited Customization

Cloud-based accounting software may have limited customization options compared to traditional accounting software. This may limit the ability of users to tailor the software to their specific needs.

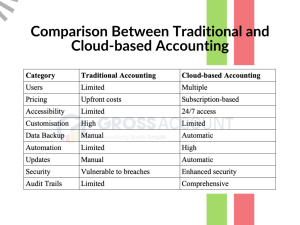

Comparison Between Traditional accounting and Cloud-based accounting

Which Software is Right for You?

GrossAccount is a company that offers accounting software solutions for businesses of all sizes. Their software is designed to be easy to use, with features that allow users to manage their financial records, track expenses, create invoices, and more. With GrossAccount you can customize your accounting software according to your business, streamline your financial operations and save time and money in the process.

Here are some of the key features of GrossAccount software

- Professional GST/Non-GST Invoice

- Stock Management Software

- Customizable accounting software configuration

- Auto Backup

- Accurate Reports

- Financial Transaction Bookkeeping

- GST Reports with GSTR-9

- Assembly-wise product stock tracking system

- Inventory Management Software

FAQs

1) Which accounting is better cloud-based or traditional?

It depends on the specific needs and preferences of the business. Traditional accounting methods can be better for businesses with limited financial data and who prefer more control over their financial data. On the other hand, cloud-based accounting can be better for businesses that require real-time access to their financial data, collaboration and scalability.

2) Which software is used in cloud-based accounting?

There are several software options available for cloud-based accounting, including GrossAccount, QuickBooks Online, Xero, FreshBooks, and Wave Accounting, among others.

3) What is computerized accounting?

Computerized accounting involves using accounting software and technology to automate and manage financial transactions and records. This includes using software to create invoices, track expenses, manage inventory, and generate financial reports.