Introduction

Managing taxes can be a challenging task for any business owner. From choosing the right tax structure to keeping track of due dates, there are many aspects to consider when it comes to managing your business taxes. However, with the right tax strategies and tools, you can reduce your tax liability, stay organized, and save time.

One tool that can help you manage your business finances and taxes is accounting software. GrossAccount is a company that provides accounting software as a service, offering a range of tools and features to help you stay on top of your finances.

In this blog post, we’ll discuss 8 tax strategies to help you get started on managing your business taxes.

Contents:

- Choose the right tax structure according to your company

- Mark due dates on the calendar

- Separate your personal and business funds

- Keep Accurate Records

- Put off taxable income for some time

- Claim tax credits and deductions

- Use accounting software

- Hire an accountant or Tax Professional

- What is the Limitation of Tax Planning?

Tax Planning Strategies

1) Choose the Right Tax Structure

The tax structure you choose for your business can have a big impact on your tax liability. Every organisation works in different kinds of areas. At some time you may have to change your business structure according to business needs. After all lot of aspects depend upon your business like Tax liability or Personal liability.

There are several options to choose from, you have to research first when selecting a business structure. Here are some the example of business structures:

- Sole proprietorship

- Partnership

- Limited Liability Company (LLC)

- Corporation

- Private Limited Company

Each structure has its own set of benefits and drawbacks, so it’s important to choose the one that best suits your business needs and goals. When it’s time to file taxes, your business structure determines what GST form you have to fill, or your tax deadline. Consult with a tax professional to help you make the right decision.

2) Mark Due Dates on Your Calendar

Different businesses have different due dates for taxes, so it’s important to stay organized and keep track of them all. Missing a due date can result in penalties and fees, which can add up over time.

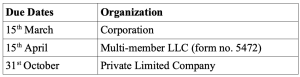

Due dates

Above you can see that corporations, LLC, and Pvt. Ltd. Companies have different due dates for filling their tax forms. Also, their tax form number are different from each other.

So, mark your calendars, set alarms for each tax payment and filing and avoid paying extra fines or penalties.

3) Separate Your Personal and Business Funds

Mixing personal and business funds can make it difficult to track your business expenses and can complicate your taxes. It’s important to keep your personal and business funds separate by opening a separate bank account and using it exclusively for business transactions. This will make it easier to keep accurate records and avoid any confusion during tax season.

4) Keep Accurate Records

Accurate record-keeping is essential for managing your business finances and taxes. You’ll need records to file your business tax return. Unless you do so, it will be impossible to accurately detail your business’s gains and losses. Organized records can help you to file your taxes and prove your claims.

Keep track of all your expenses, including:

- Bank statements

- Receipts

- Financial statements

- Invoices

- Credit card statements

If you don’t already use any software then use GrossAccount’s software to help you manage your finances and keep track of your expenses.

While paying tax, federal taxes may get the most attention, state and local taxes can also have a significant impact on your bottom line. Be sure to consider state and local taxes when planning your tax strategy.

5) Defer (Put Off) Taxable Income

Deferring taxable income means delaying income to a later date, which can help reduce your tax liability. This can be done by delaying the billing of clients until the following year or by deferring payment of invoices until after the end of the tax year. This strategy can be especially helpful if you anticipate a lower tax rate in the following year. Imagine you provided a client with services in December. By waiting until January, you might defer in income.

6) Claim Tax Credits and Deductions

Tax credits and deductions can help lower your tax liability and save you money. Make sure to keep track of all eligible expenses throughout the year and claim them on your tax return. Some common tax credits and deductions include:

- Business expenses

- Charitable donations

- employee benefits

- Work opportunity tax credits

- Healthcare insurance tax credits

- Home office tax deductions

- Loan interest tax deduction

7) Use Accounting Software

Accounting software can be a helpful tool for managing your business finances and taxes. GrossAccount provides accounting software as a service, which can help you track your expenses, manage your invoices, and generate financial reports. Using accounting software can save you time and help you stay organized throughout the year.

8) Hire an Accountant or Tax Professional

If you’re not comfortable managing your taxes, consider hiring an accountant or tax professional. An accountant can be a valuable asset for your business during tax season.

They can help you in the following:

- Navigate complex tax laws

- Maximize your deductions

- Ensure that your tax returns are filed accurately and on time

Working with an accountant can be beneficial beyond tax season, too. Regular meetings with an accountant can help you analyze your financial health, grow your business, and plan for the future. We have seen 8 tax planning strategies but they always have some limitations so let’s take a look at the Limitations of Tax Planning.

What is the Limitation of Tax Planning

There are some limitations to tax planning that businesses and individuals should be aware of. Some of these limitations include:

Changing tax laws

Tax laws are subject to change, and what may be a beneficial tax strategy today may not be effective in the future due to changes in the tax code. It’s important to stay up-to-date with changes in tax laws and regulations and adjust your tax planning strategies accordingly.

Personal circumstances

For example, a change in income level, marital status, or business ownership structure may require a reassessment of tax planning strategies.

Unforeseen events

Unexpected events, such as natural disasters, economic downturns, or changes in the market, can impact the effectiveness of tax planning strategies. It’s important to have contingency plans in place to address these events and adjust your tax planning strategies accordingly.

Ethical concerns

While tax planning is legal, there are ethical considerations to be aware of. Some tax planning strategies may be viewed as aggressive or even illegal by some individuals or organizations. It’s important to consult with a tax professional to ensure that your tax planning strategies are ethical and in compliance with applicable tax laws and regulations.

Overall, while tax planning can be a useful tool for managing tax liability, it’s important to be aware of these limitations and work with a qualified tax professional to develop and implement effective tax planning strategies.

Conclusion

Managing your business taxes can be a daunting task, but with the right tax strategies and tools, it can be much easier to stay organized and reduce your tax liability. Accounting software is one tool that can help you manage your business finances and taxes more efficiently. With its intuitive interface, powerful features, and user-friendly design, it helps you to streamline your accounting processes and make informed financial decisions.

In conclusion, by implementing these eight tax strategies and using GrossAccount’s accounting software, you can take control of your business finances and taxes. Whether you’re just starting or looking to streamline your existing accounting processes, these strategies will help you stay on top of your tax obligations and make informed financial decisions for your business. So, take the first step towards better tax management today and start implementing these strategies for your business!